Budgeting is one of the most effective tools for managing your money, yet many people either avoid it or struggle to stick with it. Often, the problem isn’t the concept of budgeting itself it’s the way it’s built. A good budget should be realistic, flexible, and tailored to your actual life, not just a list of numbers on a spreadsheet.

If you’ve tried budgeting before and it didn’t work, don’t worry. This guide will walk you through a step-by-step process for creating a monthly budget that truly works and sticks.

1. Understand Why Budgeting Matters

A budget gives you control over your money. Instead of wondering where your paycheck went at the end of the month, you’ll know exactly where it’s going and why. Budgeting helps you:

- Avoid debt

- Save consistently

- Plan for future goals

- Reduce financial stress

- Make more intentional decisions

Even if you don’t have a high income, budgeting allows you to do more with what you have.

2. Track Your Income and Expenses

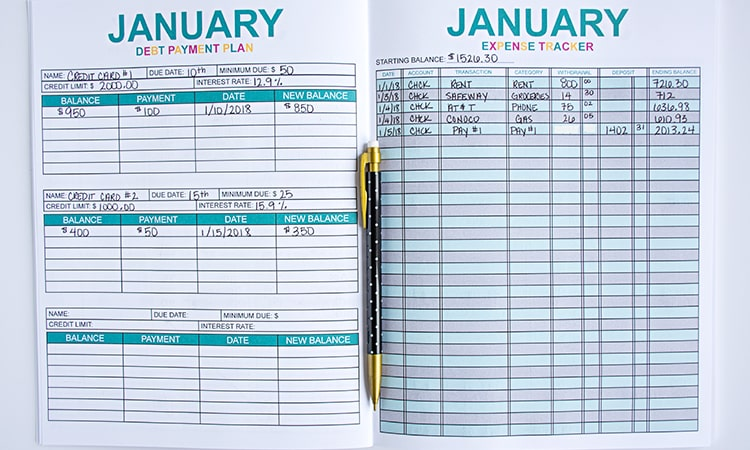

Before creating a budget, you need to understand your current financial habits. For one month, write down every source of income and every expense yes, every coffee, subscription, and cash payment.

You can do this in a notebook, spreadsheet, or with budgeting apps like YNAB (You Need a Budget), Mint, or Spendee. Categorize your spending to see patterns: housing, transportation, food, entertainment, etc.

By the end of this tracking period, you’ll likely be surprised by how much you spend in certain areas. This awareness is key.

3. Define Your Financial Goals

A budget works best when it’s tied to real life goals. Ask yourself:

- What do I want to achieve financially?

- Do I want to build an emergency fund?

- Pay off debt?

- Save for a trip, car, or down payment?

Write your goals down, and assign target amounts and deadlines. These goals will give your budget purpose and help you stay motivated.

4. Choose a Budgeting Method

There’s no one size fits all approach to budgeting. Choose a method that fits your personality and lifestyle. Here are three popular options:

a. The 50/30/20 Rule

- 50% of your income goes to needs (rent, food, bills)

- 30% goes to wants (dining out, entertainment)

- 20% goes to savings and debt repayment

This method is great for beginners and provides a balanced structure.

b. Zero-Based Budget

Every dollar has a job. You assign all your income to specific categories (including savings) until your balance is zero. This method forces full accountability.

c. Envelope System (Digital or Physical)

Assign specific amounts to categories (like groceries or gas) and stop spending once that “envelope” is empty. You can do this with cash or with apps that simulate digital envelopes like Goodbudget or Mvelopes.

5. Create Your Monthly Budget

Now it’s time to build your actual budget. Start by writing down your total monthly income after taxes. Then, list your fixed expenses (rent, insurance, loans) and variable expenses (groceries, gas, entertainment).

Be realistic. Don’t underestimate your spending. It’s better to slightly overestimate than to run out of money mid month.

Example Budget Template:

| Category | Budgeted Amount |

|---|---|

| Rent | $800 |

| Utilities | $150 |

| Groceries | $300 |

| Transportation | $120 |

| Subscriptions | $40 |

| Dining Out | $100 |

| Emergency Fund | $150 |

| Debt Repayment | $200 |

| Savings | $100 |

| Miscellaneous | $40 |

| Total | $2,000 |

Use a spreadsheet, app, or printable template to organize your categories. You can find free downloadable templates on platforms like Google Sheets, Microsoft Excel, or budget planner websites.

6. Automate Where Possible

Once your budget is set, automation can help you stay on track. Set up automatic transfers to:

- Savings accounts

- Investment accounts

- Credit card or loan payments

This reduces the temptation to spend and makes saving effortless. Many banks allow you to schedule these transfers on your payday.

7. Review and Adjust Weekly

Your budget should evolve with your life. Set a reminder to review your budget once a week. Check how much you’ve spent in each category, see what’s left, and make adjustments as needed.

Unexpected expenses happen, and that’s okay. The key is to stay flexible. If you overspend on dining out one week, try to cut back in another category or the following week.

8. Use the Right Tools

Technology makes budgeting easier than ever. Here are a few apps and platforms to consider:

- YNAB: Great for zero-based budgeting with real time updates and strong community support.

- Mint: Free and beginner-friendly. Automatically tracks your spending and categorizes it.

- EveryDollar: Created by Dave Ramsey, simple and focused on debt repayment.

- Goodbudget: Ideal for envelope budgeting, available in both free and premium versions.

- Spendee: Visually engaging, good for both personal and shared budgets.

These tools sync with your bank accounts and credit cards to track your spending automatically and provide insights through charts and alerts.

9. Common Mistakes to Avoid

- Being too strict: If your budget doesn’t allow any room for fun or small indulgences, it’s likely to fail.

- Not accounting for irregular expenses: Don’t forget annual costs like car registration or holiday spending. Set aside a little each month for these.

- Giving up after one bad month: Budgeting takes practice. If one month goes off-track, use it as a learning experience not a reason to quit.

10. Celebrate Small Wins

Reward yourself when you reach a goal, stick to your budget, or improve your savings. It could be something simple like a favorite meal, a free weekend activity, or just recognizing your progress.

Building good financial habits is a long-term process. Consistency, not perfection, is what leads to lasting success.

Real-World Examples of Budgeting in Action

Sometimes, seeing how others make budgeting work can turn abstract advice into something tangible.

Example 1 – The Freelance Designer

Maria, a freelance graphic designer, has an irregular income that fluctuates month to month. Instead of creating a rigid budget, she uses the zero-based budgeting method. She tracks all incoming payments and immediately allocates a portion toward her essentials, savings, and a “slow months” fund. This ensures she can cover expenses during quieter periods without dipping into debt.

Example 2 – The Family with Kids

David and Sarah have two children and a mortgage. They follow the 50/30/20 rule, but they also maintain a “kids and education” sinking fund. This small monthly contribution covers school supplies, extracurricular activities, and summer camp, preventing sudden large expenses from derailing their budget.

Example 3 – The Young Professional Paying Off Debt

Jason earns a steady salary but has $15,000 in student loans. He uses the debt avalanche method within his budget focusing extra payments on the debt with the highest interest rate while paying minimums on the rest. Over time, this approach saves him hundreds in interest and accelerates his payoff timeline.

Advanced Budgeting Tips to Maximize Success

Once you’ve mastered the basics, these strategies can help you squeeze even more value from your budget:

- Use Sinking Funds

Instead of letting big annual costs (like car insurance or holiday gifts) surprise you, divide them into monthly amounts and set them aside in a separate account. - Incorporate a “No-Spend Day” Rule

Pick one or two days each week where you spend nothing. This curbs impulse buying and makes you more conscious of where your money goes. - Review Your Subscriptions Quarterly

Many people pay for services they rarely use. Every three months, check your recurring payments and cancel any that don’t add real value. - Budget for Fun

Restricting yourself too much can cause “budget burnout.” Include a small category for guilt-free spending to maintain balance. - Automate Savings First, Not Last

Treat your savings like a bill. Transfer it as soon as you get paid, not after you’ve spent on other things.

Popular Budgeting Tools – Comparison Table

| Tool | Best For | Key Features | Cost |

|---|---|---|---|

| YNAB (You Need a Budget) | Serious budgeters who want to give every dollar a job | Zero-based budgeting, goal tracking, real-time sync | $14.99/month or $99/year |

| Mint | Beginners wanting automated tracking | Free expense tracking, bill reminders, credit score monitoring | Free |

| EveryDollar | Debt-focused budgeting | Simple interface, Dave Ramsey’s baby steps, manual entry (free version) | Free or $79.99/year for Plus |

| Goodbudget | Envelope-style budgeting | Digital envelopes, easy sharing for couples | Free or $8/month for Plus |

| Spendee | Visual budgeters and shared budgets | Bank sync, cash tracking, colorful charts | Free or $14.99/year for Premium |

Common Budgeting Pitfalls – and How to Fix Them

- Overcomplicating Your Budget

A budget that’s too complex can be discouraging. Start simple and add detail as you go. - Forgetting to Plan for the Unexpected

Always have a small “miscellaneous” category to catch unplanned costs. - Not Adjusting After Major Life Changes

A new job, baby, or move should trigger a full budget review to align with your new reality.

Conclusion

Creating a monthly budget that actually works isn’t about tracking every penny perfectly it’s about being intentional with your money and giving every dollar a purpose. With the right tools, realistic goals, and a method that fits your lifestyle, budgeting can become a powerful habit that helps you save more, stress less, and build a secure financial future.