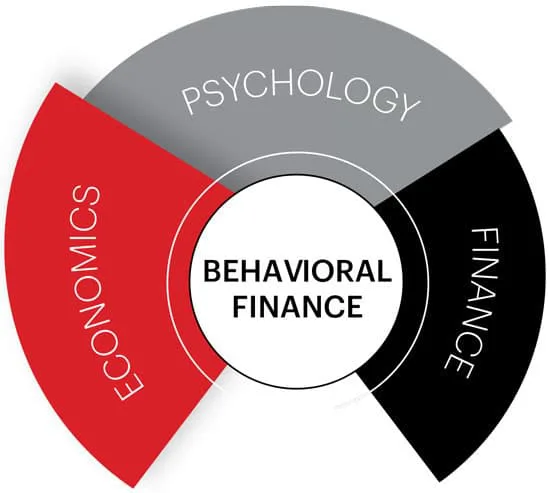

Behavioral finance is a growing field that blends psychology with economics to better understand why people make irrational financial decisions. Traditional finance theory assumes that investors are rational, emotionless beings who always make logical choices. However, real-world behavior often defies that logic. Behavioral finance provides insights into how cognitive biases and emotional reactions can influence investment behavior and sometimes lead to costly mistakes.

One of the most common psychological traps is loss aversion. This is the tendency for individuals to feel the pain of a loss more acutely than the joy of a gain of the same size. For example, losing $1,000 feels more upsetting than the satisfaction of gaining $1,000. This fear of loss can cause investors to hold onto losing investments too long, hoping they will rebound, or avoid taking necessary risks that might actually lead to gains.

Overconfidence is another prevalent bias. Many investors believe they are better at predicting markets than they actually are. This overestimation of one’s ability can result in excessive trading, taking unnecessary risks, or ignoring important market signals. Studies have shown that overconfident investors often underperform the market because they rely more on intuition than research.

Herd mentality is also significant in market behavior. Investors often follow the crowd, buying assets when everyone else is buying and selling when panic spreads. This kind of behavior can inflate bubbles where asset prices rise far beyond their actual value and lead to crashes when the bubble bursts. Historical examples like the dot-com bubble or the housing crisis highlight how dangerous herd behavior can be.

Another common bias is anchoring, where investors rely too heavily on the first piece of information they receive such as the initial price they paid for a stock. If that stock drops, they may resist selling it, waiting for it to return to that original price, regardless of new information about the company’s prospects.

Confirmation bias plays a strong role in reinforcing poor decision-making. It occurs when investors seek out news or opinions that confirm their existing beliefs and ignore anything that contradicts them. For example, someone who believes a particular stock will rise might ignore warnings or negative earnings reports because they don’t fit the narrative they want to believe.

To mitigate these behavioral pitfalls, it’s essential to create and follow a well-thought-out investment plan. Establishing clear goals, risk tolerance levels, and a long-term strategy can help reduce emotional reactions to short-term market fluctuations. Automated investing platforms or robo-advisors can also be useful in removing emotional decision-making by sticking to pre-set strategies.

Practicing mindfulness and self-awareness can also go a long way. Understanding your own biases and emotional responses to financial news or market changes is the first step in managing them. Keeping a journal of investment decisions and the rationale behind them can help identify patterns over time and improve future choices.

Diversification is another strategy that can reduce the impact of behavioral mistakes. By spreading investments across asset classes and regions, investors are less likely to make reactive decisions based on the performance of a single stock or sector.

Education also plays a key role in combating emotional investing. The more you understand about markets, investment products, and financial history, the more likely you are to remain calm and rational during periods of uncertainty. Learning from past market cycles both booms and busts can help set realistic expectations and encourage a disciplined approach.

Financial advisors can also help investors stay on track. A trusted advisor can act as a voice of reason during market turbulence and provide objective guidance based on long-term goals. Many advisors today incorporate behavioral coaching into their services, helping clients avoid impulsive decisions and stick to their financial plan.

Behavioral Finance: How Psychology Shapes Your Investment Decisions

In theory, investing should be a purely logical process a matter of crunching numbers, analyzing market data, and making decisions based on cold, hard facts.

In reality, though, humans are emotional creatures. We react to fear, greed, hope, and regret. These emotions, along with built-in cognitive biases, often cause us to make decisions that go against our own best interests.

This is where behavioral finance steps in a fascinating field that combines psychology and economics to explain why people make irrational financial choices and, more importantly, how we can avoid these costly mistakes.

Why Traditional Finance Falls Short

Traditional finance assumes that investors are:

- Rational decision-makers.

- Fully informed about all available information.

- Consistently focused on maximizing returns.

But history from the dot-com bubble in the late 1990s to the housing crisis in 2008 proves otherwise. Investors often follow trends, act impulsively, or ignore warning signs, even when the data tells a different story.

Behavioral finance acknowledges this gap and studies the human side of investing: how our brains, emotions, and biases influence the choices we make.

The Most Common Behavioral Biases in Investing

1. Loss Aversion

Humans feel the pain of losing money much more strongly than the joy of gaining it.

Psychologists estimate losses are felt about twice as strongly as equivalent gains.

Example: If you lose $1,000 on a trade, it may haunt you for weeks but gaining $1,000 might only bring a brief smile.

Impact on investing:

- Holding onto losing stocks too long, hoping they’ll recover.

- Avoiding necessary risks that could actually help grow your wealth.

2. Overconfidence

Many investors believe they can outsmart the market predicting tops, bottoms, or the “next big thing.”

Impact on investing:

- Excessive trading.

- Ignoring important data or alternative viewpoints.

- Taking on too much risk without realizing it.

Studies have shown that overconfident investors often underperform the market because they act on intuition rather than research.

3. Herd Mentality

Humans are social creatures, and we tend to follow the crowd especially when it comes to money.

Impact on investing:

- Buying during market hype (often at inflated prices).

- Selling in panic when others are selling (locking in losses).

Historic examples:

- Dot-com bubble (1990s): Investors piled into tech stocks with little to no profits.

- 2008 housing market: Millions followed the trend of buying homes at inflated prices.

4. Anchoring

We often cling to the first piece of information we receive like the price we paid for a stock.

Impact on investing:

- Refusing to sell at a loss, even when fundamentals worsen.

- Making decisions based on outdated or irrelevant data.

5. Confirmation Bias

We like to be “right,” so we tend to seek out information that supports our existing beliefs while ignoring contradictory evidence.

Impact on investing:

- Ignoring negative news about a company you’re invested in.

- Following only sources that agree with your market view.

How to Overcome Behavioral Biases

The good news? You don’t have to be a victim of your own brain. Here are strategies to reduce emotional decision-making:

1. Have a Written Investment Plan

Include:

- Clear financial goals.

- Your target asset allocation.

- Rules for when to buy, sell, or hold.

This acts as a “decision anchor” during volatile markets.

2. Automate Your Investing

Using automated contributions or robo-advisors removes the temptation to time the market. Dollar-cost averaging helps smooth out entry points and avoids emotional buying or selling.

3. Diversify Your Portfolio

By spreading investments across different asset classes, sectors, and regions, no single poor performer can sink your portfolio. This also reduces the urge to make reactive decisions.

4. Practice Mindfulness

Being aware of your emotional triggers can prevent knee-jerk reactions. Some investors keep a decision journal recording each investment choice, why they made it, and how they felt at the time.

5. Educate Yourself

Understanding past market cycles — both booms and busts — builds perspective. Education gives you the confidence to hold your ground during turbulence.

6. Work with a Financial Advisor

A trusted advisor acts as a voice of reason, helping you avoid impulsive moves and stick to your long-term plan. Many now include behavioral coaching as part of their service.

Real-World Example: How Biases Play Out

Imagine an investor named Laura:

- In early 2020, she watched markets plunge due to COVID-19 fears.

- Loss aversion made her sell at a loss, locking in damage.

- Later, when markets recovered, herd mentality led her to buy back in at higher prices.

- By acting on emotion instead of data, Laura underperformed the market.

Now imagine if Laura had a written plan, automated investments, and the patience to ride out volatility. Not only would she have avoided unnecessary losses, but she could have profited from the recovery.

Why Behavioral Finance Matters More Than Ever

With investing becoming more accessible through apps and online platforms, the temptation to trade often and act on impulse is greater than ever. Push notifications, social media hype, and “meme stocks” can amplify herd behavior and overconfidence.

That’s why building emotional discipline is now just as important as learning how to read a balance shee

In conclusion, behavioral finance sheds light on the psychological factors that influence investment decisions. Recognizing and managing these biases can improve both individual financial outcomes and overall market stability. As investing becomes more accessible through digital platforms, the importance of emotional discipline and informed decision-making is greater than ever. By integrating behavioral awareness into investment strategies, individuals can build resilience and confidence on their path to financial success.