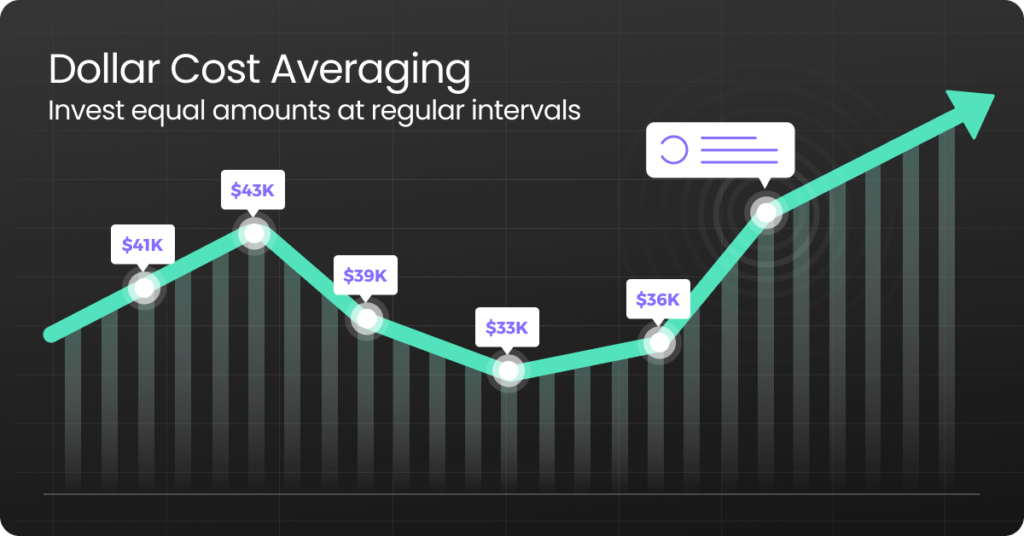

Dollar-cost averaging (DCA) is a powerful investment strategy, especially useful during uncertain or volatile market conditions. It involves investing a fixed amount of money at regular intervals, regardless of the asset’s price.

The core idea is to buy more shares when prices are low and fewer when prices are high, thus averaging out your cost per share over time. This technique reduces the emotional stress of trying to time the market perfectly. Many beginner investors benefit from DCA because it encourages consistency and discipline.

DCA works best with long-term investments like index funds, mutual funds, or ETFs. It’s also an ideal strategy for people who receive monthly income and want to invest gradually. While it doesn’t guarantee profits or prevent losses, it can minimize risk and smooth out market fluctuations.

This strategy is especially useful in retirement accounts or for building wealth steadily. Automation makes DCA easy many platforms let users set up recurring investments. While lump-sum investing can be more profitable during bull markets, DCA offers a safer approach for those concerned about volatility.

Ultimately, dollar-cost averaging promotes patience, reduces the impact of market timing mistakes, and helps investors stay committed to their financial goals.

2. The Role of Bonds in a Diversified Investment Portfolio

While stocks get most of the attention, bonds play a crucial role in a balanced investment strategy. Bonds are debt securities issued by governments or corporations to raise capital, and they offer regular interest payments to investors.

Bonds are generally less volatile than stocks, making them a good option for reducing portfolio risk. They provide steady income and preserve capital, especially during market downturns. Investors approaching retirement often allocate more to bonds to protect their savings.

There are different types of bonds government bonds (like U.S. Treasuries), municipal bonds, and corporate bonds. Each has different risk levels and returns. Government bonds are considered safer but offer lower yields, while corporate bonds carry more risk but offer higher potential returns.

Including bonds in your portfolio helps smooth out returns over time and serves as a hedge against stock market declines. The key is to find the right balance. Younger investors might prefer a stock-heavy portfolio, while older investors lean toward a bond-heavy mix.

In summary, bonds are a valuable tool for income, diversification, and stability. They may not be as flashy as stocks, but they are essential to a smart investment strategy.

3. Understanding ETFs: Why They’re Ideal for Modern Investors

Exchange-Traded Funds (ETFs) have gained immense popularity in recent years and for good reason. They combine the diversification benefits of mutual funds with the flexibility of stock trading.

An ETF is a collection of assets (stocks, bonds, commodities) bundled together and traded on an exchange. When you buy an ETF, you gain exposure to a wide variety of assets, often within a specific sector, index, or theme.

ETFs are ideal for beginner and experienced investors alike because they offer low expense ratios, instant diversification, and tax efficiency. You can find ETFs that track broad indices like the S&P 500 or niche sectors like clean energy or AI.

Another key benefit is liquidity. Unlike mutual funds, which only trade at the end of the day, ETFs can be bought and sold throughout the trading day at market prices. This flexibility gives investors more control.

Whether you’re building a retirement fund or trying to capitalize on a specific trend, ETFs provide an easy and affordable way to diversify. Understanding how they work helps you build a resilient and responsive portfolio.

4. Inflation and Your Investments: What You Need to Know

Inflation is the gradual increase in prices over time, which reduces the purchasing power of your money. For investors, this poses a serious threat if your investment returns don’t outpace inflation, your wealth is effectively shrinking.

Historically, inflation averages around 2–3% per year, but periods of higher inflation like in recent years can erode returns quickly. That’s why it’s crucial to understand how to inflation-proof your portfolio.

Assets like stocks, real estate, commodities, and Treasury Inflation-Protected Securities (TIPS) often outperform during inflationary periods. Real assets like property and infrastructure investments tend to maintain value, while fixed-income investments (like regular bonds) may lose purchasing power.

Investors must also factor inflation into long-term financial planning especially for retirement. Adjusting return expectations and saving goals accordingly can help avoid shortfalls.

In conclusion, inflation is an unavoidable economic force, but by choosing the right assets and maintaining a diversified portfolio, you can protect and even grow your purchasing power over time.

5. Behavioral Finance: How Your Mind Can Sabotage Your Wealth

Behavioral finance is the study of how psychological influences affect investor decisions. It explores why people often make irrational choices that can harm their financial health.

Common biases include:

- Loss aversion: People fear losses more than they value gains, leading to overly conservative strategies or panic-selling.

- Herd mentality: Investors follow the crowd, often buying at market peaks and selling during crashes.

- Overconfidence: Believing you’re always right can lead to risky, unchecked decisions.

- Anchoring: Relying too heavily on one piece of information like a stock’s past high can distort judgment.

Understanding these biases can help you avoid costly mistakes. Developing an investment plan, using automation, and regularly reviewing your strategy objectively are ways to mitigate emotional investing.

In essence, mastering your mindset is just as important as mastering the markets. Behavioral finance shows that personal discipline, education, and awareness are vital for long-term success.