Managing money doesn’t have to be complicated. While there are countless budgeting tools and financial strategies available, one simple framework has stood the test of time for its practicality and clarity the 50/30/20 rule. This guideline offers a straightforward way to distribute your monthly income into three main categories: needs, wants, and savings. It’s perfect for beginners looking to build strong financial habits without getting overwhelmed.

In this article, we’ll explore what the 50/30/20 rule is, how to apply it to your financial life, and how it can help you achieve both short-term stability and long-term goals.

What Is the 50/30/20 Rule?

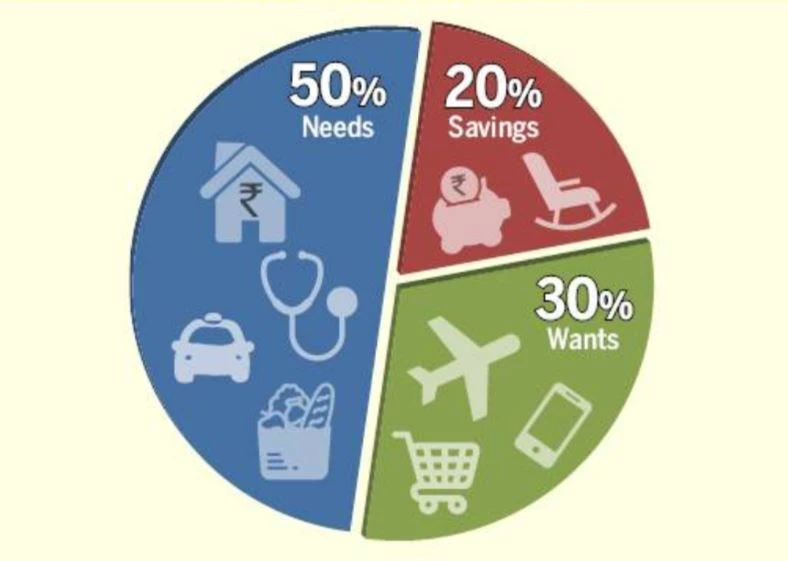

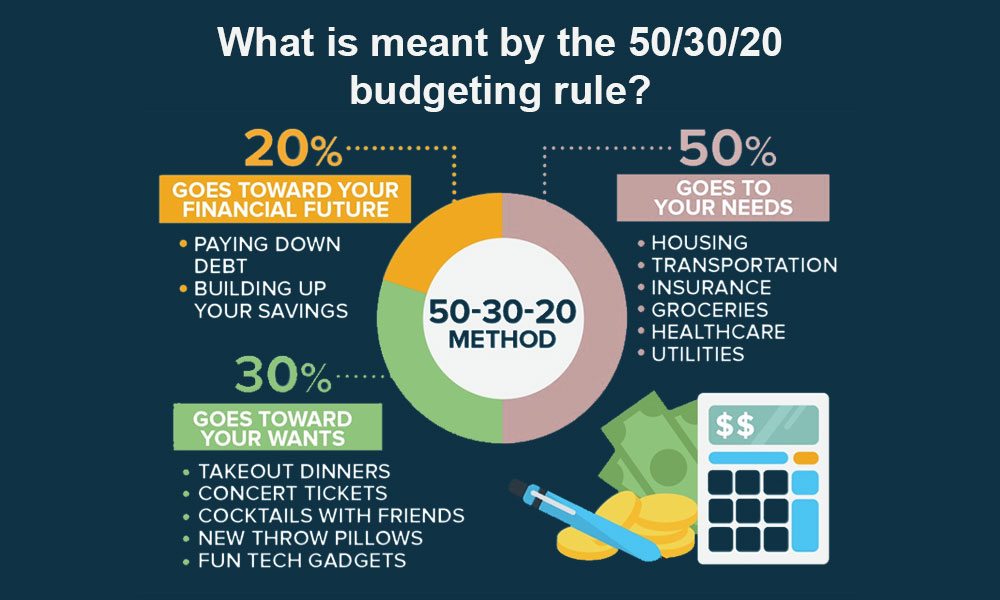

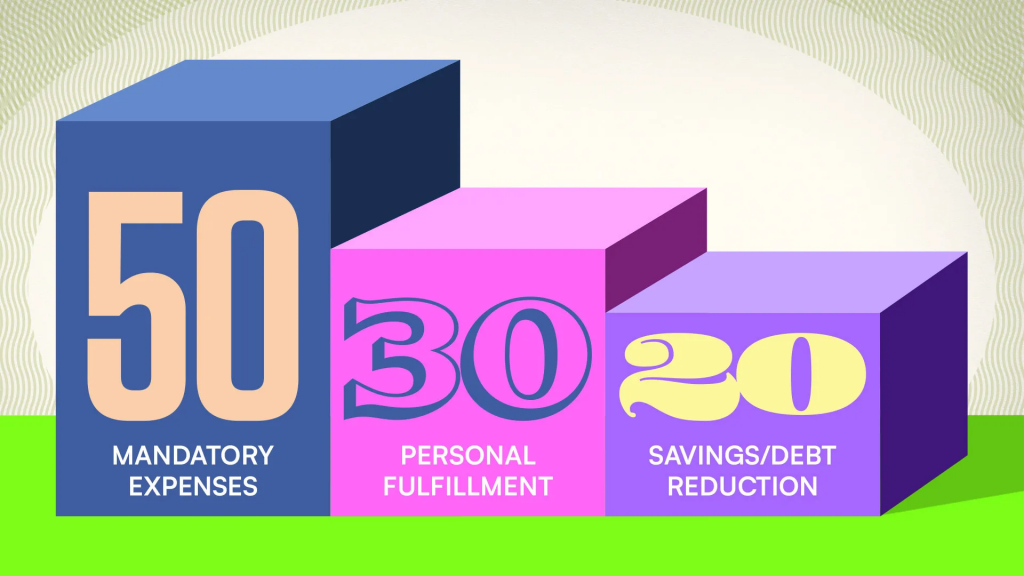

The 50/30/20 rule is a budgeting method popularized by U.S. Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan.” It recommends dividing your after-tax income as follows:

- 50% for Needs: Essential living expenses

- 30% for Wants: Non-essential lifestyle choices

- 20% for Savings and Debt Repayment

This model encourages balance ensuring you cover the essentials, enjoy life, and still prepare for the future.

Step 1: Calculate Your After-Tax Income

Before applying the rule, determine your net income the amount you take home after taxes and deductions. If you’re a salaried employee, this is typically your paycheck amount. If you’re self-employed or have variable income, subtract taxes and business expenses from your gross income to find your true take-home pay.

For example, if your monthly take-home income is $3,000, your 50/30/20 breakdown would look like this:

- Needs: $1,500

- Wants: $900

- Savings/Debt Repayment: $600

Step 2: Allocate 50% to Needs

Needs are the essentials you must pay for to live and work. These include:

- Rent or mortgage payments

- Utilities (electricity, water, gas)

- Groceries

- Health insurance

- Transportation

- Minimum debt payments

Needs are non-negotiable and should not exceed 50% of your income. If your essential expenses take up more than that, it may be necessary to:

- Downsize your living situation

- Use public transportation

- Shop more consciously for groceries

- Renegotiate bills or service plans

The goal is to keep this category lean so you can afford both enjoyment and financial growth.

Step 3: Assign 30% to Wants

Wants are the non-essential things that enhance your lifestyle. These include:

- Dining out

- Travel and vacations

- Subscriptions (Netflix, Spotify, etc.)

- Hobbies and entertainment

- Upgraded electronics or fashion

These are expenses that you can technically live without but that contribute to your overall quality of life. This is where the 50/30/20 rule shines it gives you room to enjoy life without guilt, as long as you’re sticking to your limits.

However, it’s easy to confuse wants with needs. For instance, a basic mobile phone plan may be a need, but upgrading to the latest smartphone every year falls into the “want” category.

Step 4: Dedicate 20% to Savings and Debt Repayment

The final 20% of your income should be directed toward improving your financial future. This category includes:

- Emergency fund contributions

- Retirement accounts (IRA, 401(k), etc.)

- Investment accounts

- Extra payments on credit cards or student loans

- High-interest debt reduction

This portion is about building financial resilience and preparing for long-term stability. If you don’t already have at least 3–6 months of living expenses in an emergency fund, start there. Afterward, focus on debt reduction and investment.

If you’re carrying high-interest debt, consider allocating most of this category toward extra payments to reduce the interest you’re paying over time.

Why the 50/30/20 Rule Works

- Simplicity: It removes the need for micromanaging every dollar

- Flexibility: Works well with both fixed and variable incomes

- Balance: Encourages both enjoyment and responsibility

- Scalability: Can be used at any income level

The rule also promotes a healthy financial mindset by reinforcing that money management isn’t just about deprivation it’s about making room for priorities while still enjoying your life.

When the 50/30/20 Rule May Not Be Ideal

While the rule works for many people, it may not fit every situation. For example:

- Low-income households might spend more than 50% on basic needs, making it hard to save or spend on wants.

- High-income earners might want to save or invest more than 20% for faster financial independence.

- People with heavy debt may need to devote more than 20% toward repayments in the short term.

In such cases, consider adjusting the ratios. For example, you might try 60/20/20 or 50/20/30 just make sure your basic structure includes needs, wants, and future planning.

Tips to Stick With the 50/30/20 Rule

- Automate your finances: Set up automatic transfers to savings and bill payments.

- Use budgeting apps: Tools like YNAB, Mint, or PocketGuard can help track categories.

- Review monthly: Financial habits shift over time check your budget regularly.

- Use cash or debit for wants: This helps limit overspending on non-essentials.

The 50/30/20 rule is celebrated for its simplicity, but its real power lies in how you adapt it to your life. Many people stop at the surface level they split their income, pay their bills, and save a little. But if you understand how to optimize each category, you can accelerate your financial growth, improve lifestyle satisfaction, and create a more resilient money plan.

Advanced Category Optimization

1. Mastering the 50% Needs Section

It’s not just about keeping this section at half your income it’s about optimizing each expense so you get the best value for your money.

Practical optimization tips:

- Housing: Negotiate rent, refinance your mortgage at a lower rate, or explore house-hacking (renting a portion of your home to cover costs).

- Utilities: Use energy-efficient appliances, install smart thermostats, and review provider options annually.

- Groceries: Plan meals in advance, shop with a list, and buy in bulk for frequently used items.

- Transportation: Compare owning vs. leasing vs. public transport; sometimes car-sharing services are more economical than full ownership.

The goal here is value per dollar, not just cutting costs for the sake of it.

2. Elevating the 30% Wants Category

Many budgeting guides treat “wants” as guilty pleasures. But strategic spending here can actually increase your earning potential and life satisfaction.

Smart ways to spend wants:

- Invest in skill-building courses or certifications that aren’t strictly “necessary” but can lead to higher income.

- Allocate part of this budget for experiences travel, concerts, events which have been shown to increase long-term happiness.

- Support hobbies that may later evolve into income streams, like photography, design, or writing.

By viewing “wants” as quality-of-life investments, you make sure your spending aligns with your deeper goals.

3. Maximizing the 20% Savings & Debt Repayment Section

Here’s where the magic of the 50/30/20 rule really compounds over time.

Advanced strategies:

- Use sinking funds: Set aside money for predictable future expenses (car replacement, home repairs) so you don’t have to use credit later.

- Leverage tax-advantaged accounts: Max out contributions to retirement accounts (IRA, 401(k), Roth IRA) where possible.

- Automate investing: Set automatic transfers into index funds or ETFs right after payday.

- Snowball or avalanche debt repayment: Snowball focuses on quick wins (paying smallest balances first), while avalanche saves more on interest (paying highest interest first).

Adapting the Rule to Different Incomes

The original 50/30/20 split works best for middle-income households, but here’s how to tweak it:

For higher incomes:

- Shift to 40/20/40 (needs/wants/savings) to speed up wealth accumulation.

- Focus heavily on investments and passive income generation.

For lower incomes:

- Start with 60/20/20, then work toward lowering needs to 50% as your income grows.

- Use part of the “wants” budget for skill-building to increase earning capacity.

Mindset Shifts That Make the Rule More Effective

- Pay Yourself First

Instead of saving “what’s left,” treat savings as a non-negotiable bill. Automate it. - Think in Percentages, Not Fixed Numbers

This makes your budget adaptable to changing income levels. - Value-Driven Spending

Every dollar spent should align with something you truly value, not impulse buys. - Progressive Goals

Over time, aim to reduce “wants” to 20–25% and increase savings to 25–30%.

Case Study: Applying the Rule in Real Life

Example:

- After-tax income: $5,000/month

Original split:

- Needs: $2,500

- Wants: $1,500

- Savings/Debt: $1,000

Optimized split after 1 year of expense review:

- Needs: $2,200 (downsized apartment, switched to a more affordable phone plan)

- Wants: $1,300 (redirected part to skill-based courses)

- Savings/Debt: $1,500 (increased investments + faster debt payoff)

Result:

In one year, the extra $500/month in savings compounded into $6,000, plus reduced debt interest costs.

Avoiding Common Pitfalls

- Overestimating Needs: Many people categorize wants as needs. Be strict with definitions.

- Lifestyle Creep: When income rises, resist expanding wants proportionally.

- Neglecting Inflation: Adjust your budget annually to account for cost-of-living changes.

- Ignoring Irregular Income: For freelancers, base your budget on your lowest average monthly income, not your best months.

Tech Tools to Enhance the Rule

- YNAB (You Need A Budget): Excellent for goal-based budgeting and tracking categories.

- PocketGuard: Shows how much “spendable” money remains after bills and goals.

- Tiller Money: Spreadsheet-based tracking for those who prefer customization.

- Empower (formerly Personal Capital): Best for integrating budgeting with investment tracking.

Integrating the Rule With Other Financial Strategies

The 50/30/20 rule can be the base framework, but you can layer other systems on top:

- Zero-Based Budgeting: Assign every single dollar a job while still respecting the 50/30/20 ratios.

- Reverse Budgeting: Automatically fund savings and investments first, then divide the rest into needs and wants.

- Cash Envelope Method: Use physical or digital envelopes for discretionary spending.

The Psychological Benefit of the Rule

One underrated aspect is that it removes guilt from spending. When you know you’re saving enough and covering needs, you can enjoy your wants freely without second-guessing every coffee or movie ticket.

It also builds decision-making clarity. Instead of debating over every purchase, you simply check which category it belongs to and whether it fits your pre-set limits.

Long-Term Wealth Impact

Following the rule over 10–20 years can transform your finances. Even modest savings compounded with regular investment can:

- Fund early retirement.

- Provide financial security against job loss.

- Create generational wealth through property, stocks, or business ownership.

Final Thoughts

The 50/30/20 rule is a powerful tool for creating financial clarity and balance. It simplifies money management by guiding you toward a structure that supports your needs, allows for guilt-free enjoyment, and builds a secure financial future.

Whether you’re just starting your financial journey or reassessing your current habits, this rule can serve as a reliable foundation. Adjust it to fit your circumstances, track your progress, and make intentional financial choices. With consistency, you’ll not only feel more in control—you’ll also move closer to long-term financial success