Understanding the difference between assets and liabilities is one of the most fundamental principles in personal finance and investing. These two terms define how your money works for or against you. While the concept may seem simple at first glance, the distinction is critical for building wealth and making smart financial decisions.

In this article, we’ll explain what assets and liabilities are, how they impact your financial health, and how to apply this knowledge to your investment strategy and long-term goals.

What Is an Asset?

An asset is anything that has value and can generate income or appreciate over time. In personal finance, assets are typically things that:

- Increase your net worth

- Put money in your pocket

- Retain or grow in value over time

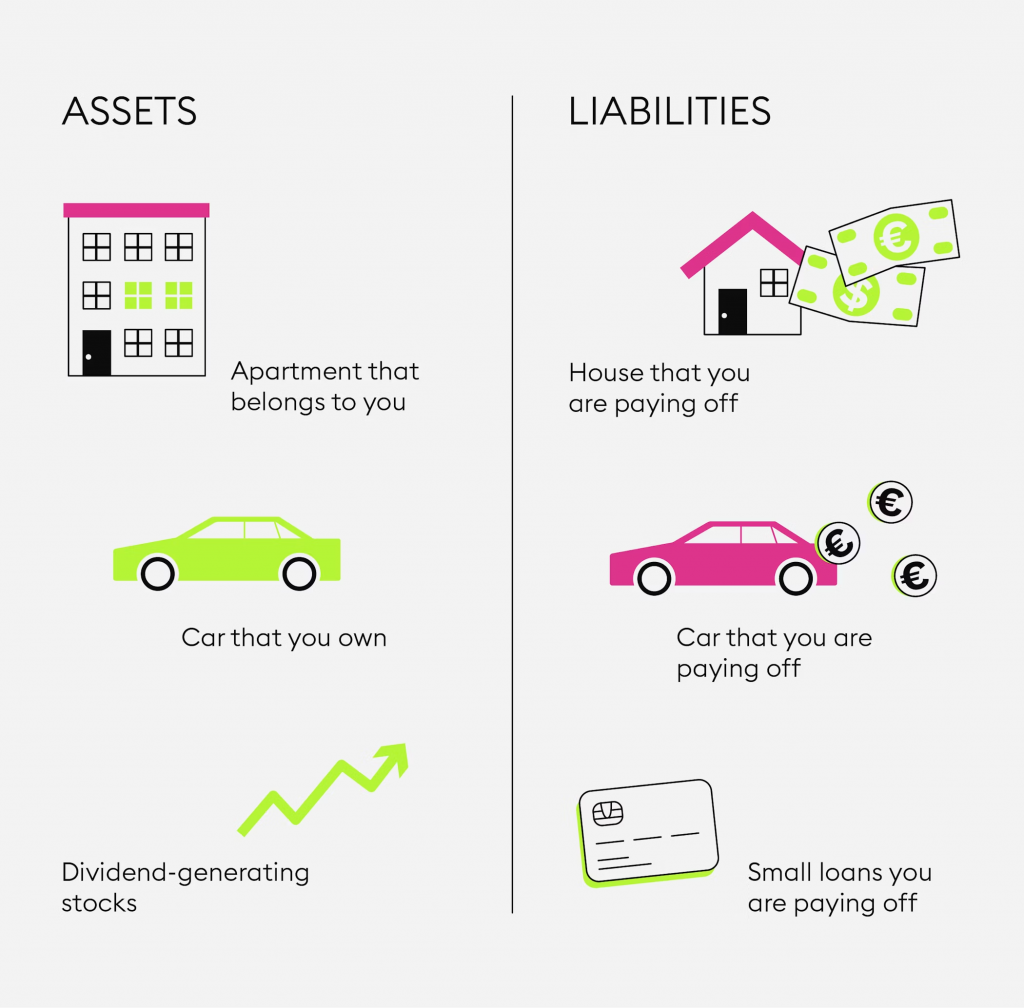

Examples of assets include:

- Real estate that generates rental income

- Stocks, mutual funds, and index funds

- Bonds and fixed-income investments

- Cash and savings accounts

- Businesses or side hustles that generate profit

- Intellectual property (e.g., patents, trademarks, royalties)

It’s important to note that not all assets are equally productive. A car may be listed as an asset on your balance sheet, but it depreciates over time and does not generate income so it’s a non-productive asset. On the other hand, a dividend-paying stock grows your wealth passively.

What Is a Liability?

A liability is a financial obligation something that costs you money. Liabilities reduce your net worth because they represent debts or obligations you must pay.

Examples of liabilities include:

- Mortgages

- Credit card debt

- Auto loans

- Student loans

- Personal loans

- Unpaid taxes

- Monthly expenses that exceed your income

Some liabilities are considered “good debt” if they fund investments (such as a mortgage on a rental property), while others are purely consumption-based (like credit card debt for non-essentials).

The Key Difference

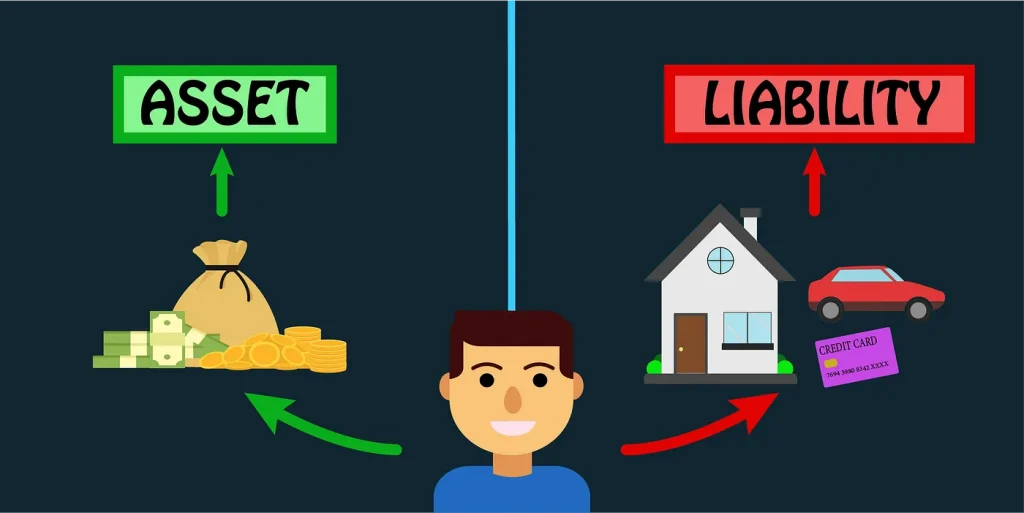

The simplest way to remember the distinction:

- Assets = Money in

- Liabilities = Money out

When you invest in an asset, it works for you. When you take on a liability, you’re working to pay it off. To grow wealth, your goal should be to accumulate income-generating assets while minimizing or eliminating liabilities.

Assets and Liabilities in Action: Personal Examples

Let’s compare two everyday items that many people own:

1. Your Home

- Some view their primary residence as an asset. While it may appreciate in value, it does not generate income. In fact, it requires maintenance, taxes, insurance, and mortgage payments.

- From an investment standpoint, a rental property that provides monthly income is a true asset.

2. A Car

- Cars lose value over time and require regular maintenance, insurance, and fuel. Unless you use the car for business or ridesharing income, it’s a liability, not an asset.

This doesn’t mean you shouldn’t buy a home or a car—it means you should understand their financial impact clearly.

Building Your Personal Balance Sheet

Creating a personal balance sheet helps you visualize where you stand financially.

Assets

- Home equity

- Investment accounts

- Retirement accounts (401(k), IRA)

- Savings

- Valuable personal property (art, collectibles)

Liabilities

- Mortgage balance

- Student loan debt

- Credit card balances

- Auto loan balance

- Personal loans

Net Worth = Total Assets – Total Liabilities

Tracking this regularly helps you see if your wealth is growing or shrinking and where you need to make changes.

Why the Asset vs. Liability Mindset Matters

Developing a mindset that prioritizes assets over liabilities is key to financial independence. Many people increase their income, only to raise their spending and take on more debt this is called lifestyle inflation.

Instead, focus on:

- Using surplus income to buy appreciating or income-generating assets

- Avoiding debt for non-essential purchases

- Reducing monthly liabilities to free up cash for investment

- Thinking long-term: Will this purchase grow or drain my wealth?

How Investors Use This Knowledge

Smart investors constantly analyze opportunities in terms of assets and liabilities.

1. Buying Cash-Flowing Assets

They prioritize assets that generate passive income like dividend stocks, rental real estate, or royalties.

2. Using Leverage Wisely

While debt (a liability) is often discouraged, it can be used strategically. For example, taking a loan to buy a rental property that yields positive cash flow can increase overall returns.

3. Avoiding Consumer Liabilities

Investors avoid high-interest debt like credit cards, car loans, and personal loans that don’t support wealth building activities.

4. Focusing on Asset Appreciation

They consider not only how much an asset pays now, but how much it could grow in value over time.

Common Misconceptions

“If I own something, it’s an asset.”

Not necessarily. If it doesn’t generate income or appreciate in value, it’s not an asset from an investor’s point of view.

“All debt is bad.”

Not true. Strategic, low-interest debt used to acquire appreciating or income producing assets can be beneficial.

“I can’t build assets until I make more money.”

Even small, consistent investments (like automatic deposits into an index fund) are a great start. Many millionaires began with modest incomes.

How to Shift Toward an Asset-Based Life

- Track Your Net Worth Quarterly

Watch your assets grow and your liabilities shrink. This helps you stay focused. - Set Asset Accumulation Goals

Plan to buy a property, invest monthly in stocks, or start a small business. Set milestones and track progress. - Delay Gratification

Rather than spending windfalls, use them to buy appreciating assets. - Automate Investments

Set up automatic contributions to a brokerage or retirement account, so you’re always acquiring assets. - Use Income to Acquire More Assets

Reinvest dividends, rental income, or business profits to create a compounding effect.

Assets vs. Liabilities: The Foundation of Wealth Building

Understanding the difference between assets and liabilities is one of the most fundamental principles in personal finance and investing. These two terms define how your money works either for you or against you. While the idea may sound simple, mastering it is the key to building long-term wealth and avoiding financial traps.

What Is an Asset?

An asset is anything of value that adds to your net worth and has the potential to generate income or appreciate over time. From an investor’s perspective, the true power of an asset lies in its ability to put money in your pocket whether actively or passively.

Common examples of assets:

- Real estate that produces rental income.

- Stocks, ETFs, and index funds that grow in value and/or pay dividends.

- Bonds and fixed-income instruments that generate interest.

- Cash and savings accounts (though their value may be eroded by inflation).

- Businesses or side hustles producing profits.

- Intellectual property such as books, patents, trademarks, or music royalties.

💡 Key takeaway: Not all assets are productive. For example, a personal car is technically an asset on paper, but if it doesn’t generate income and loses value, it’s a depreciating asset.

What Is a Liability?

A liability is a financial obligation something that takes money out of your pocket. Liabilities reduce your net worth because they represent debts, contracts, or expenses you are required to pay.

Common examples of liabilities:

- Mortgages on your home (unless it generates income).

- Credit card debt.

- Auto loans.

- Student loans.

- Personal loans.

- Taxes owed.

- Ongoing expenses exceeding income.

Some liabilities can be “productive debt” if they help you acquire assets for example, a mortgage on a rental property that generates more income than the loan costs.

The Core Difference: Money In vs. Money Out

- Assets = Money flows in

- Liabilities = Money flows out

When you buy an asset, you’re putting your money to work. When you take on a liability, you’re committing to work (and earn) to pay it back.

Real-Life Comparisons

1. Your Home

- As a residence → May appreciate over time, but it doesn’t produce income and requires maintenance, taxes, and insurance.

- As a rental property → Generates monthly rent that can exceed expenses, making it a true asset.

2. Your Car

- Loses value over time, requires fuel, insurance, and repairs.

- Exception: If used for income (e.g., ridesharing, delivery services, or a business), it can be considered a productive asset.

Building Your Personal Balance Sheet

Creating a personal balance sheet helps you see where you stand financially.

Assets:

- Home equity.

- Investment and retirement accounts.

- Savings.

- Valuable collectibles.

Liabilities:

- Mortgage balance.

- Student loans.

- Credit card debt.

- Auto loans.

Net Worth = Total Assets – Total Liabilities.

Tracking this at least quarterly helps you measure progress.

Why This Mindset Matters

Many people increase their earnings only to increase their spending a trap called lifestyle inflation. The wealthy think differently: they direct extra income toward buying assets, not liabilities.

Wealth-focused habits:

- Channeling bonuses or extra income into investments.

- Avoiding high-interest consumer debt.

- Reducing unnecessary monthly payments.

- Prioritizing purchases that will appreciate or produce income.

How Investors Use This Principle

1. Buying Cash-Flowing Assets

From rental properties to dividend stocks, investors prioritize assets that keep generating income.

2. Using Leverage Strategically

Borrowing (a liability) can be smart if it buys an asset that earns more than the cost of debt. Example: Using a low-interest loan to purchase an apartment building.

3. Avoiding Consumer Liabilities

High-interest credit cards, car loans, and personal loans drain wealth instead of growing it.

4. Balancing Growth and Income

Investors look for assets that provide both for example, stocks with dividend growth.

Common Misconceptions

- “If I own it, it’s an asset.”

Not necessarily from an investment perspective, it must generate income or appreciate. - “All debt is bad.”

Productive debt that finances an appreciating asset can be a powerful wealth-building tool. - “I can’t invest until I earn more.”

Even small, consistent investments compound over time.

Strategies to Shift Toward an Asset-Based Life

- Track Net Worth Quarterly

Measure progress and adjust spending/investing habits. - Set Asset Accumulation Goals

Example: Buy one rental property in 5 years or invest $500/month into ETFs. - Delay Gratification

Redirect windfalls into appreciating assets instead of consumer goods. - Automate Investments

Schedule automatic deposits into investment or retirement accounts. - Reinvest Income from Assets

Use dividends, rental profits, or business earnings to acquire more assets.

Avoiding Common Traps

- Overleveraging: Taking on too much debt in pursuit of assets can backfire during market downturns.

- Ignoring Depreciation: Some purchases marketed as “investments” lose value quickly (e.g., new cars, electronics).

- Not Considering Liquidity: Some assets, like real estate, can take time to sell.

- Chasing Quick Returns: Focusing only on speculative gains can turn assets into liabilities if losses occur.

Assets and Liabilities in Business

In entrepreneurship, the same rule applies:

- Business assets: Equipment that generates products, intellectual property, profitable customer contracts.

- Business liabilities: Loans, unpaid supplier invoices, or high fixed costs without corresponding revenue.

The best businesses maximize productive assets and minimize non-essential liabilities.

The Long-Term Vision

The ultimate goal is financial independence, where income from assets covers your living expenses. This is achievable through:

- Real estate portfolios.

- Dividend-focused stock investing.

- Profitable businesses.

- Royalties and intellectual property.

Over time, as assets grow and liabilities shrink, your net worth compounds putting you in a stronger, more resilient financial position.

Final Thoughts

Understanding the difference between assets and liabilities is more than just financial literacy it’s a philosophy for building wealth. Once you begin evaluating every purchase, loan, and investment through this lens, your financial behavior starts to change for the better. By focusing on acquiring real assets and reducing unnecessary liabilities, you’ll build a stronger, more resilient financial future one that works for you, not the other way around.