The rise of the creator economy marks one of the most transformative shifts in digital entrepreneurship over the last decade. Powered by platforms like YouTube, TikTok, Patreon, Substack, and Twitch, the creator economy enables individuals to monetize content directly, build loyal audiences, and, in many cases, earn a living doing what they love. But beyond being a cultural revolution, the creator economy is also opening a new frontier for investors.

What Is the Creator Economy?

The creator economy consists of content creators YouTubers, podcasters, streamers, bloggers, newsletter writers, musicians who earn revenue through digital channels. These earnings might come from ad revenue, subscriptions, merchandise sales, brand sponsorships, or tips from fans.

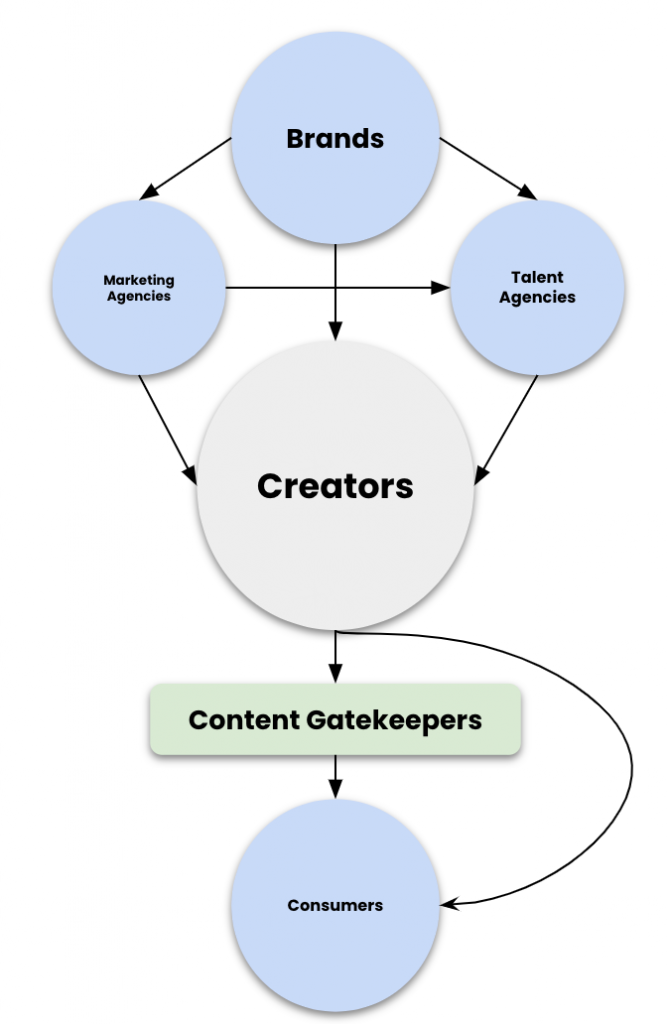

Unlike traditional media models, the creator economy allows individuals to control their content, distribution, and monetization strategies. It also enables niche communities to thrive, offering personalized and authentic content that often outperforms legacy institutions in terms of engagement.

Why It’s an Emerging Investment Frontier

The creator economy is projected to be a $100+ billion market, and its rapid expansion has drawn attention from venture capital, institutional investors, and individual backers alike. Here’s why it’s compelling:

- Decentralized Growth: It’s not dependent on traditional media or gatekeepers.

- Low Overhead, High Return: Many creators operate with minimal costs.

- Scalability: Successful creators can reach millions and scale income with relatively fixed expenses.

- Multiple Revenue Streams: Ads, subscriptions, NFTs, courses, events, and product collaborations create layered income opportunities.

Ways to Invest in the Creator Economy

- Public Companies Fueling the Ecosystem Invest in publicly traded companies that support or monetize the creator economy, such as:

- Alphabet (YouTube)

- Meta Platforms (Instagram, Facebook, Threads)

- Amazon (Twitch)

- Spotify (podcasts, creator tools)

- Adobe (creative software)

- Unity or Roblox (game creators)

- Creator Economy Startups Use platforms like AngelList or Republic to back early-stage startups building tools for creators think monetization apps, video editing software, or audience analytics tools. While riskier, the upside can be significant.

- Creator Funds and Influencer Ventures Some creators offer investment opportunities directly or launch their own brands/products. Influencers may create venture funds or tokenize parts of their future revenue. Platforms like Roll or BitClout (now DeSo) experiment with this model.

- Patronage-Based Platforms While not traditional investing, supporting creators on Patreon or Substack can act as micro-investments in their future. In some cases, early support leads to revenue-sharing arrangements or exclusive benefits.

- NFTs and Web3 Creators The Web3 space has unlocked new monetization forms for digital artists, musicians, and video creators through NFTs and blockchain-based ownership. Investing in creator-led NFT projects or utility tokens offers exposure to this innovation frontier.

Risks and Considerations

- Creator Dependency: Revenue often depends on a single personality. If that person quits or burns out, earnings drop.

- Platform Control: Creators rely on platforms with changing algorithms, monetization rules, or even bans.

- Hype Cycles: Certain segments (e.g., NFTs) are prone to speculative bubbles.

- Valuation Uncertainty: Many creator economy startups are still early-stage, with unclear paths to profitability.

How to Evaluate Creator Economy Investments

- Audience Engagement: It’s not about follower count it’s about loyalty, community, and interaction.

- Revenue Mix: Are earnings diversified? Ads, sponsorships, and direct sales?

- Growth Metrics: Look for consistent subscriber growth, increasing views/downloads, or strong conversion rates.

- Content Quality and Brand Identity: A well-defined niche and authentic voice are assets.

- Team and Tech: For platforms or tools, assess the founding team’s experience and product roadmap.

Success Stories

- MrBeast: One of YouTube’s top creators, he’s launched a burger chain, a snack brand (Feastables), and multiple businesses backed by venture capital.

- Ali Abdaal: A former doctor turned YouTuber who created a 7-figure education business through courses and memberships.

- Substack Writers: Journalists and thought leaders now earn more independently than through traditional media outlets.

The Democratization of Media

Investing in the creator economy is more than chasing returns it’s about supporting a shift in how culture, education, and entertainment are produced and consumed. Audiences now choose creators based on value, relatability, and authenticity not institutional reputation.

Tips for Individual Investors

- Start with ETFs or Big Tech Stocks: Get indirect exposure via companies powering the infrastructure.

- Support Small Creators: Crowdfunding or pre-launch support can build relationships and early-stage opportunities.

- Be Cautious with Trend-Driven Hype: Focus on long-term utility and sustainable business models.

- Stay Informed: Follow industry news, creator earnings reports, and platform policies.

Expanding the Creator Economy Investment Landscape

While the creator economy has become synonymous with influencers and social media personalities, the scope of this sector is far broader. It includes independent educators, game developers, writers, filmmakers, and even subject-matter experts producing niche content for small but highly engaged audiences. This diversity is one of its biggest strengths because it allows investors to tap into numerous sub-markets, each with its own growth drivers and revenue potential.

One of the most notable shifts is the rise of multi-platform presence. Successful creators rarely rely on a single platform for their income. Instead, they distribute content across YouTube, TikTok, Instagram, newsletters, podcasts, and live events. This approach not only diversifies their revenue streams but also shields them from the risk of sudden algorithm changes or monetization policy shifts on any one platform. For investors, creators with a well-developed multi-platform strategy are generally more resilient and scalable.

Another important area to watch is the professionalization of creator businesses. Many top creators now operate as small media companies, complete with production teams, marketing staff, and business development managers. This operational structure allows them to manage multiple revenue channels simultaneously from e-commerce and branded merchandise to licensing deals and premium subscription services. Investors who understand this evolution can identify opportunities in creator-led brands that function more like startups than personal side projects.

The creator tools and infrastructure segment is also becoming a lucrative investment category. Platforms that provide editing software, analytics, audience engagement tools, and monetization solutions are vital to the ecosystem. As creators grow, their need for professional-grade tools increases, creating recurring revenue opportunities for these service providers. Companies like Adobe, Canva, and Streamlabs have already capitalized on this trend, but new startups continue to emerge with specialized offerings for specific creator niches.

Live and interactive experiences are another growth frontier. From virtual concerts and workshops to metaverse meet-and-greets, creators are increasingly blending entertainment with community engagement in ways that deepen fan loyalty. These formats often command higher ticket prices or subscription fees and create unique sponsorship opportunities. Investors should pay attention to companies building the technology and infrastructure for these immersive creator experiences.

There is also an emerging intersection between the creator economy and decentralized technologies. Blockchain enables creators to issue their own tokens, sell fractional ownership of future earnings, or create NFT-based memberships that unlock exclusive benefits. While speculative elements remain, the potential for creators to establish direct, blockchain-verified relationships with their audience could reduce platform dependency and shift more control toward the individual.

For those evaluating investments in this space, brand alignment and audience trust are crucial. The creator’s relationship with their audience is their most valuable asset, and any partnership or monetization effort that undermines authenticity can quickly erode value. Conversely, creators who maintain a strong personal brand while integrating products or services seamlessly into their content often achieve higher conversion rates and long-term revenue stability.

The global reach of the creator economy cannot be overstated. Language-specific and region-specific creators are building massive audiences in markets outside North America and Western Europe. For investors, this means opportunities exist not just in English-speaking channels but in local-language content with untapped advertising and sponsorship potential.

Long-term growth in this sector is also being fueled by the rise of niche education. Online courses, mentorship programs, and specialized communities are allowing creators to monetize expertise in fields ranging from coding and design to personal finance and wellness. These offerings tend to have higher margins than ad-supported content and can be scaled with minimal incremental cost.

As the creator economy matures, data analytics will play an even bigger role in identifying high-potential investments. Key performance indicators like audience retention, engagement-to-follower ratios, revenue per user, and churn rates will become standard tools for valuing creator-driven businesses. Investors who build or access accurate performance dashboards will have a competitive edge in identifying emerging talent before they reach mainstream recognition.

For individuals entering this space, starting small by supporting or investing in mid-tier creators can be a practical way to learn the dynamics of creator-led ventures. These creators often have dedicated audiences and room for growth but may be undervalued compared to celebrity-level influencers. In many cases, modest capital injections such as funding better equipment, marketing campaigns, or product launches can yield substantial returns as the creator scales.

Ultimately, the creator economy represents more than a passing trend it reflects a structural change in how media is produced, distributed, and monetized. For investors, the challenge lies in navigating a landscape that blends artistry with entrepreneurship, where the human element is as important as the financial model. Those who approach it with patience, cultural awareness, and a willingness to embrace digital-first business models can find opportunities that deliver both financial and cultural impact.

Final Thoughts

The creator economy is a powerful force that blends technology, entrepreneurship, and media. While still evolving, it offers fertile ground for strategic investors willing to embrace digital innovation. As the lines between creator and business continue to blur, those who recognize the potential of this new economy may find both meaningful impact and significant returns.

Investing in the creator economy isn’t just a financial decision it’s a bet on the future of work, content, and influence.