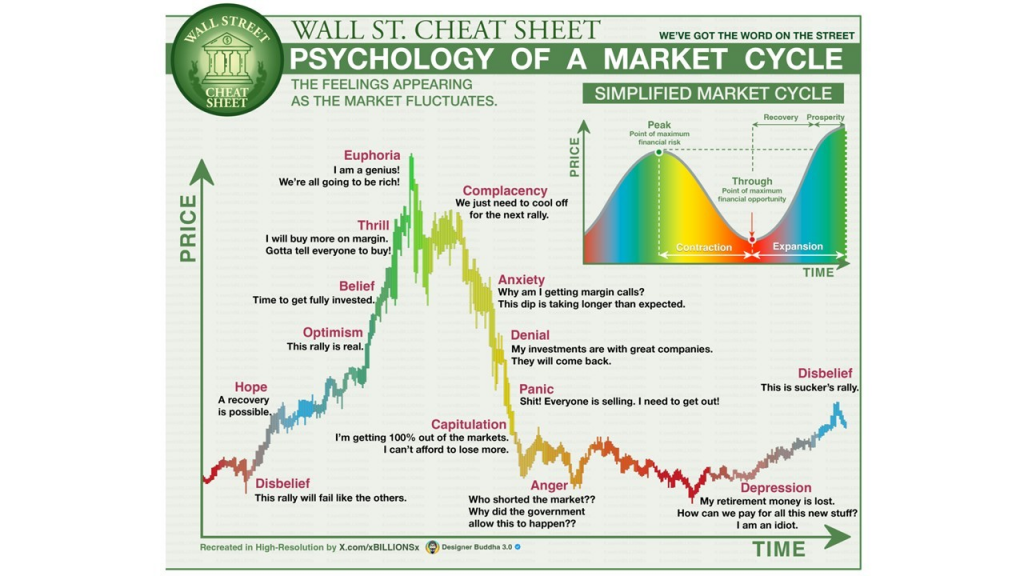

Markets are often thought of as rational systems based on fundamentals like earnings, interest rates, and economic indicators. However, behind every market movement lies a powerful psychological force: human emotion. Understanding the psychology of market cycles how fear and greed can dominate rational thinking is key for any investor seeking to make smart, long-term decisions.

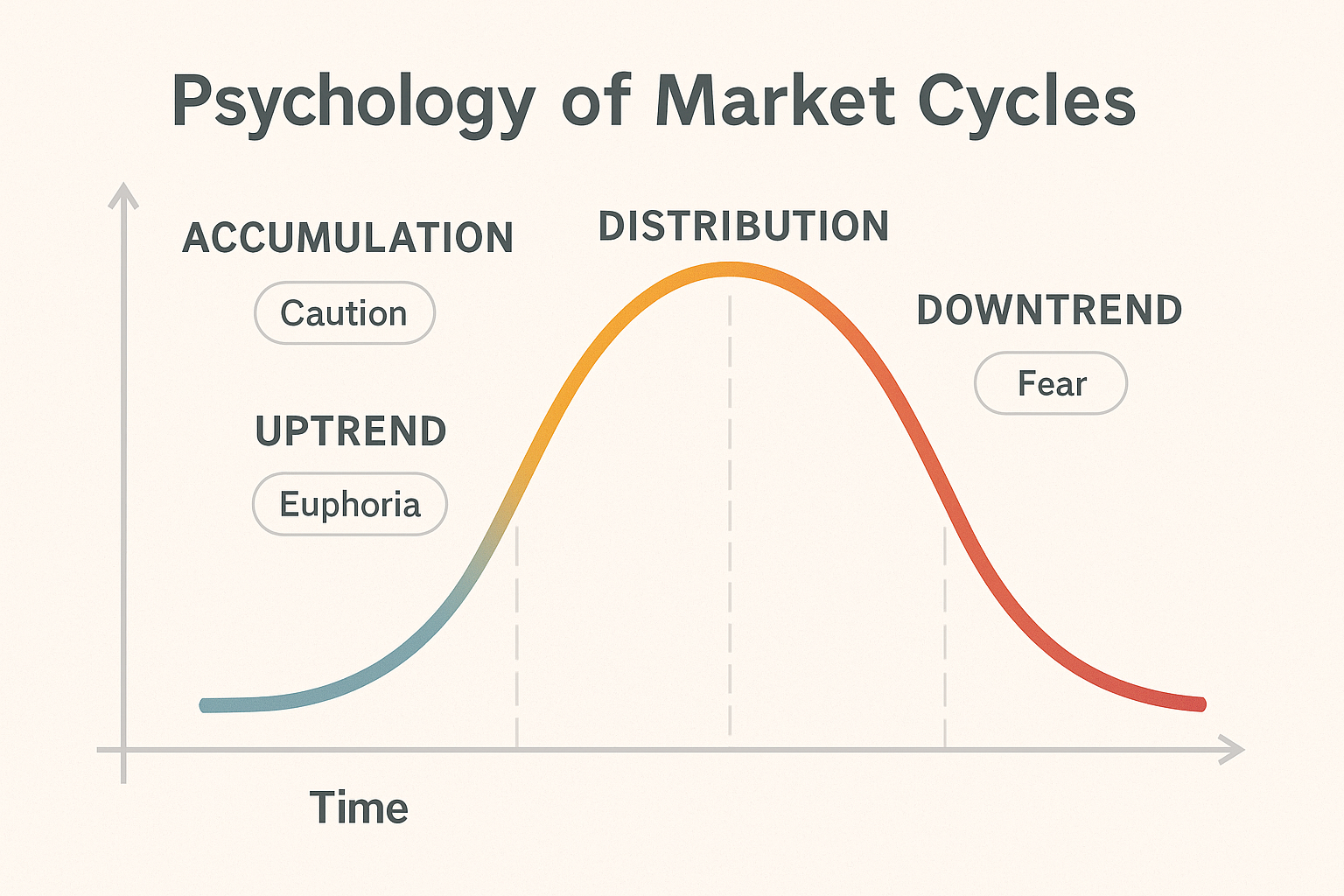

A market cycle typically consists of four main phases: accumulation, uptrend (or bull market), distribution, and downtrend (or bear market). Each of these phases is shaped not only by financial data but also by investor sentiment.

1. Accumulation Phase: The Calm Before the Boom

This phase begins when the market has bottomed out, often after a period of widespread pessimism. Prices are low, and many investors are fearful or apathetic. Savvy institutional investors and value seekers begin to accumulate assets quietly. The emotional state here is cautious optimism but it’s not yet mainstream.

At this stage, there’s little media attention and public interest is low. It’s the part of the cycle where rational investors who ignore the crowd can find the best opportunities.

2. Uptrend Phase: The Rise of Optimism

As prices begin to rise, optimism returns. More investors start to enter the market, fueled by media coverage and strong performance. This is where greed starts to creep in.

Retail investors join in, not wanting to miss out on gains. Stocks, real estate, and other assets experience surging prices. The emotional tone is one of excitement and confidence. This can lead to herd behavior, where investors buy because others are buying, not because the fundamentals justify it.

Eventually, euphoria sets in. This is the most dangerous emotional point of the cycle. Everyone is convinced the market will continue to rise indefinitely. Valuations become overstretched, risk is ignored, and “new paradigm” thinking sets in (as seen during the dot-com bubble).

3. Distribution Phase: The Shift in Sentiment

In this phase, smart money begins to exit. Prices may still rise, but at a slower pace or with increased volatility. Market sentiment starts to change. News becomes mixed, and some investors grow cautious.

This is where confusion and cognitive dissonance often appear. People are unsure whether to hold on or sell. Many ignore warning signs due to confirmation bias, believing the market will continue upward. Others simply hope things will stay good long enough to get out with profits.

Volume and volatility increase as optimism battles with doubt. Often, inexperienced investors buy during this stage, thinking they’ve found a “dip,” while more experienced players are preparing for a downturn.

4. Downtrend Phase: Fear Takes Over

Eventually, markets begin to decline significantly. News turns negative, earnings disappoint, and panic sets in. The emotional atmosphere shifts from doubt to fear, then despair.

Investors begin selling at a loss, hoping to avoid further decline. Some freeze entirely, unsure of what to do. Media amplifies the negativity, making things worse. At this point, loss aversion becomes dominant people would rather avoid losses than seek gains.

This is when the most damage is done not necessarily to portfolios, but to investor psychology. Many people sell at the bottom, locking in losses and swearing off investing altogether.

Ironically, this is when the cycle resets. As panic subsides and prices become undervalued, rational investors start to re-enter the market, starting the accumulation phase once again.

Emotional Traps in Market Cycles

- FOMO (Fear of Missing Out): Drives buying at peaks.

- Panic Selling: Leads to locking in losses at the bottom.

- Anchoring: Holding onto a stock because of a previous high, not current reality.

- Overtrading: Triggered by overconfidence or constant news monitoring.

How to Stay Grounded

Understanding the emotional stages of a market cycle is crucial for building long-term wealth. Here’s how investors can protect themselves:

- Stick to a long-term plan: Know your goals and risk tolerance. Don’t let short-term fear or hype derail your strategy.

- Diversify your portfolio: This helps smooth volatility and reduces the urge to react emotionally to one asset’s performance.

- Rebalance regularly: Adjust your portfolio periodically to maintain target allocations.

- Stay informed but not obsessed: Don’t base decisions solely on news headlines or social media sentiment.

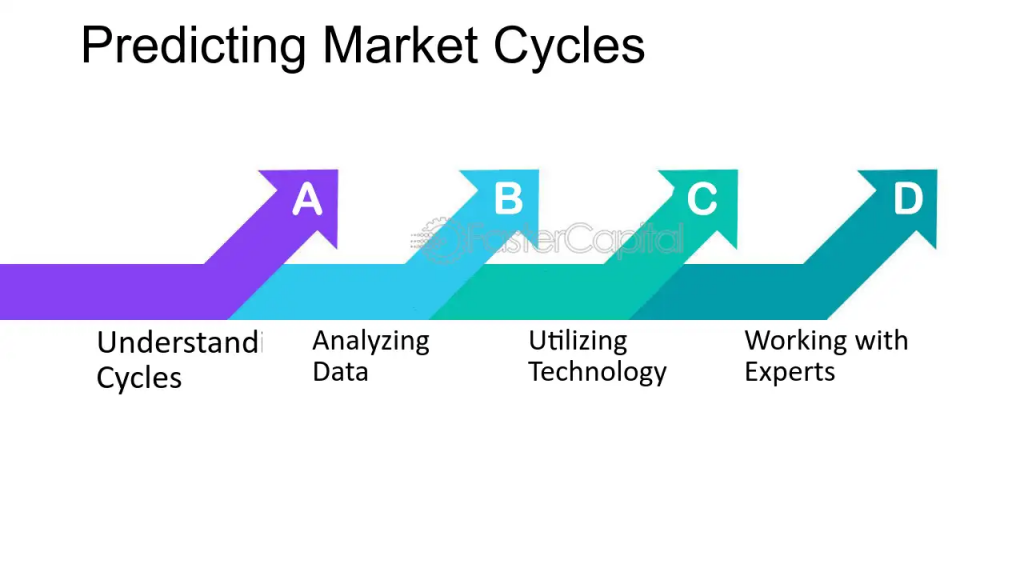

- Work with a financial advisor: A good advisor can serve as an emotional buffer during market swings.

Historical Examples of Market Psychology in Action

To truly understand the psychology behind market cycles, it’s helpful to look at real-world examples. History provides numerous cases where investor sentiment played an outsized role in market movements.

The Dot-Com Bubble (Late 1990s – 2000)

The late 1990s saw explosive growth in internet-based companies. Valuations soared, often without solid earnings to justify them. The emotional driver was euphoria investors believed the internet would revolutionize everything (which it did, but not every company survived). Many businesses with little more than a website and an idea achieved billion-dollar valuations. When reality set in and profitability failed to materialize, the market collapsed. Investors who bought late in the cycle experienced heavy losses, while those who kept discipline and invested in fundamentally strong tech companies reaped rewards in the following decade.

The Bitcoin Boom of 2017

Cryptocurrencies offer another example of sentiment-driven markets. In 2017, Bitcoin’s price surged from under $1,000 to nearly $20,000 in less than 12 months. Much of this rise was fueled by media hype, retail investor enthusiasm, and FOMO. The lack of understanding about blockchain technology didn’t stop new buyers from jumping in. When prices corrected in 2018, panic selling took over. Investors who had a long-term plan and a clear risk management strategy managed to navigate the downturn far better than those acting on emotion.

The U.S. Housing Market Pre-2008

While this example is more complex, the psychology is similar. A widespread belief that “housing prices never go down” led to overleveraging, speculative buying, and inflated valuations. As the market corrected, fear took over, and asset values plummeted. This shows how herd mentality can operate in any asset class, not just stocks.

Practical Strategies to Avoid Emotional Pitfalls

1. Use Historical Context as a Guide

Looking at past market cycles can help you understand that booms and busts are natural. While no two cycles are identical, human psychology tends to repeat itself. When you see excessive optimism or extreme pessimism dominating headlines, it’s often a signal to act cautiously.

2. Create an Investment Policy Statement (IPS)

An IPS is a personal blueprint for investing. It outlines your goals, risk tolerance, asset allocation, and decision-making rules. By setting these guidelines in advance, you have a reference point during turbulent times, reducing the urge to make emotional trades.

3. Automate Investments

Dollar-cost averaging investing a fixed amount at regular intervals takes the emotion out of timing the market. It ensures you buy during highs, lows, and everything in between, smoothing out your average cost over time.

4. Keep a “Why I Bought” Journal

Every time you make an investment, write down your reasons. Include metrics, expectations, and your time horizon. If you later feel tempted to sell based on short-term news, revisit your notes. This can help you differentiate between a genuine change in fundamentals and a knee-jerk emotional response.

5. Monitor Sentiment Indicators

Some investors use tools that measure market sentiment, such as the Fear & Greed Index, put/call ratios, or fund flow data. While not perfect, these indicators can alert you when emotions may be driving markets to extremes.

The Role of Patience in Long-Term Success

Patience is one of the most underrated traits in investing. Great investors understand that wealth builds over decades, not weeks. By resisting the temptation to act on every headline or market swing, you allow compounding to work in your favor.

For example, if you had invested $10,000 in a broad market index fund 20 years ago and left it untouched reinvesting dividends along the way your investment could have tripled or even quadrupled despite multiple market downturns. The key wasn’t perfect timing; it was simply staying invested.

Blending Psychology with Fundamentals

While understanding emotions is vital, it should be paired with solid financial analysis. A disciplined investor considers valuation metrics, industry trends, and company performance alongside market sentiment. This balanced approach helps you avoid being swept up entirely by emotion while still recognizing the power it has over short-term price movements.

Conclusion

Markets will always be influenced by human emotion that will never change. What you can control is your reaction. By studying historical cycles, setting clear rules, and maintaining discipline, you can position yourself to make rational decisions even when the market is anything but.

Remember: The best opportunities often arise when emotions are at their extremes. Fear creates bargains; greed creates bubbles. If you can learn to step back, observe, and act based on strategy rather than impulse, you’ll be ahead of the majority of investors.