Value investing has been a cornerstone of successful long-term wealth building for nearly a century. Popularized by Benjamin Graham and later refined by Warren Buffett, this investment strategy focuses on buying undervalued stocks with strong fundamentals. But does value investing still work in today’s fast-moving, tech-driven markets?

The short answer is yes when done thoughtfully and with updated tools, value investing remains one of the most powerful ways to grow wealth with lower risk.

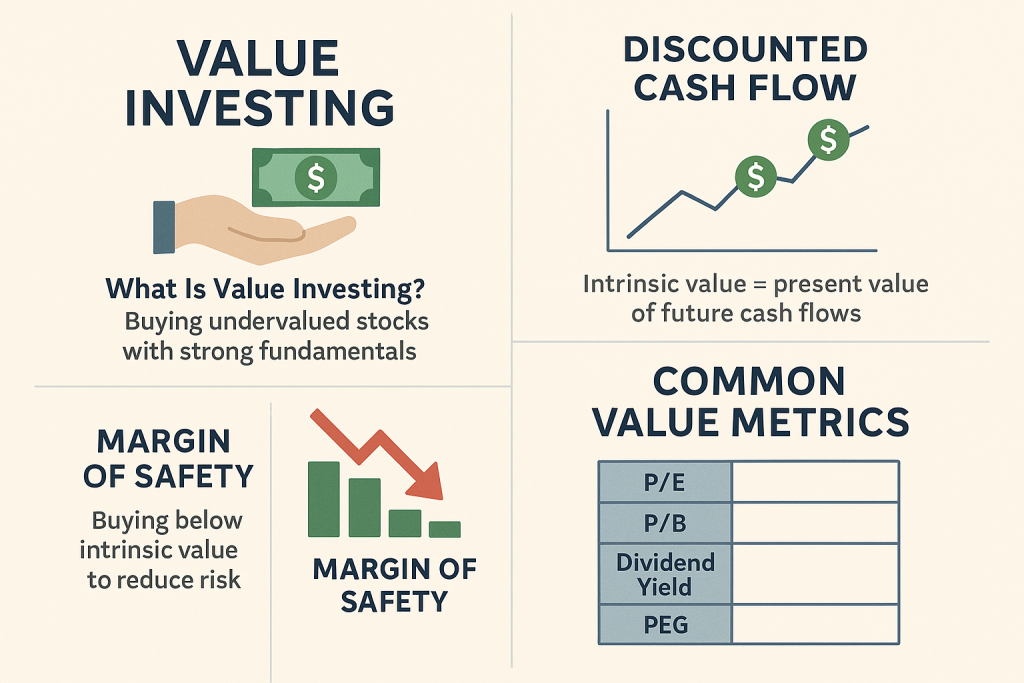

What Is Value Investing?

At its core, value investing is the practice of identifying stocks that are trading for less than their intrinsic value. These stocks may be overlooked by the market for various reasons temporary setbacks, cyclical downturns, or simply being unfashionable. The value investor believes the market will eventually recognize the true worth of the company, resulting in price appreciation.

Key elements include:

- Analyzing financial statements

- Identifying undervalued companies

- Investing with a margin of safety

- Holding long-term

Why Value Investing Still Works

Despite the rise of algorithmic trading and high growth tech stocks, value investing still works because it’s grounded in solid business fundamentals. Here’s why:

- Market Inefficiencies Still Exist – Behavioral biases and short-term thinking lead to irrational pricing.

- Long-Term Performance – Value stocks historically outperform growth stocks over decades.

- Lower Volatility – Many value companies are cash-flow positive and dividend-paying.

- Focus on Fundamentals – Less reliance on hype or speculation.

How to Practice Value Investing Today

1. Understand Intrinsic Value

Use discounted cash flow (DCF) models or earnings-based valuation to assess a stock’s real worth.

2. Look for Margin of Safety

Only buy when the market price is well below your calculated intrinsic value.

3. Analyze Financial Health

Check for:

- Low debt

- Strong return on equity (ROE)

- Consistent earnings

- Free cash flow

4. Identify Moats

Strong companies have competitive advantages like brand dominance, patents, or cost advantages.

5. Use Modern Tools

Platforms like Finviz, Simply Wall St, and YCharts help screen and analyze faster than manual methods.

Common Value Metrics

- P/E Ratio – Look for lower than average, but watch for red flags.

- P/B Ratio – Useful in asset-heavy industries.

- Dividend Yield – A bonus for holding undervalued dividend-paying stocks.

- PEG Ratio – Helps balance valuation with growth expectations.

Classic vs. Modern Examples

Classic: Coca-Cola (KO)

- Global brand, stable earnings

- Long-term performance, slow but steady

Modern: Meta Platforms (META) in 2022

- Temporarily undervalued after bad press

- Strong fundamentals

- Rebounded significantly

Modern Challenges

- Speculation Dominates – Meme stocks and social media trends can distort valuations.

- Tech Market Dominance – Value underperforms in aggressive tech bull runs.

- Interest Rate Sensitivity – Changing rates affect investor sentiment.

- Emotional Discipline – Value investing demands patience and conviction.

Tips for New Value Investors

- Think Long Term – Avoid chasing short-term gains.

- Study the Business – Not just the stock chart.

- Diversify – Don’t rely on just one or two picks.

- Ignore Hype – Focus on real data, not headlines.

Value Investing in 2025: Adapting Timeless Principles to a Changing World

Value investing has been a cornerstone of successful long-term wealth building for nearly a century. Popularized by Benjamin Graham and later refined by Warren Buffett, this investment strategy focuses on buying undervalued stocks with strong fundamentals.

But with the world dominated by AI-driven trading algorithms, disruptive startups, and faster market cycles, many investors wonder:

Does value investing still work in today’s fast-moving, tech-driven markets?

The short answer is yes when applied thoughtfully, with modern research tools and a disciplined mindset, value investing remains one of the most powerful and lower-risk strategies to build wealth.

What Is Value Investing?

At its core, value investing is the practice of identifying stocks that are trading for less than their intrinsic value. These “discounted” stocks might be temporarily ignored or misunderstood by the market for reasons such as:

- Short-term earnings drops

- Negative headlines

- Sector downturns

- Simply being “out of fashion” with investors

The value investor’s belief is simple: the market will eventually recognize the company’s real worth, and when that happens, the stock price will rise to reflect it.

The Core Pillars of Value Investing

- Deep Financial Analysis – Studying balance sheets, income statements, and cash flow statements to understand a company’s true health.

- Buying with a Margin of Safety – Purchasing only when a significant gap exists between price and intrinsic value.

- Patience – Allowing time for the market to correct its mispricing.

- Long-Term Focus – Ignoring daily volatility and focusing on multi-year performance.

Why Value Investing Still Works in 2025

Despite the rise of algorithmic trading, meme stock hype, and speculative bubbles, the foundations of value investing remain strong. Here’s why:

- Market Inefficiencies Persist – Emotional investing, fear, and greed still cause irrational pricing.

- Historical Outperformance – Over decades, value stocks have tended to outperform growth stocks.

- Lower Volatility – Value companies often have solid balance sheets, steady earnings, and pay dividends.

- Focus on Real Businesses – This strategy avoids chasing hype and instead looks for sustainable business models.

Modern Tools for Value Investors

In the past, value investing required manually digging through company reports. Today, technology has made it far more efficient. Some useful platforms include:

- Finviz – Quick stock screeners for value metrics.

- Simply Wall St – Visual, easy-to-understand analysis of company fundamentals.

- YCharts – Advanced data for institutional-level research.

- Morningstar – Long-term performance data and fair value estimates.

How to Practice Value Investing in 2025

- Calculate Intrinsic Value

- Use Discounted Cash Flow (DCF) models.

- Compare intrinsic value with the current market price.

- Look for a Margin of Safety

- Target at least a 25–40% discount from intrinsic value before buying.

- Analyze Financial Health

- Low debt-to-equity ratio.

- Positive free cash flow.

- Consistent profitability.

- Identify Moats (Competitive Advantages)

- Strong brands, patents, network effects, or cost advantages.

- Diversify Across Sectors

- Don’t put all your money in one industry.

Common Value Metrics

- P/E Ratio – Lower than industry average (but beware of “value traps”).

- P/B Ratio – Good for asset-heavy companies like banks or manufacturers.

- Dividend Yield – Extra income while holding undervalued stocks.

- PEG Ratio – Balances valuation with growth.

Examples of Value Investing in Action

Classic Example: Coca-Cola (KO)

- Strong brand presence.

- Reliable dividend payments.

- Slow but steady appreciation.

Modern Example: Meta Platforms (META) in 2022

- Fell sharply due to negative press and market fear.

- Fundamentals remained strong.

- The stock rebounded over 100% in the following year.

The Challenges of Value Investing Today

- Speculation Dominance – Social media hype can overshadow fundamentals.

- Tech Sector Bias – Growth stocks can outperform in bull runs.

- Rising Interest Rates – Can lower valuations and slow price recoveries.

- Patience is Rare – Most traders want quick profits, making long-term investing psychologically harder.

Mistakes to Avoid in Value Investing

- Falling for Value Traps – A stock can be cheap for a reason, such as declining industry relevance.

- Ignoring Qualitative Factors – Culture, management, and adaptability are crucial.

- Overconcentration – Putting too much capital into one company increases risk.

- Lack of Patience – Selling too soon before value is realized.

- Blindly Following Gurus – Even Warren Buffett makes mistakes; do your own research.

Advanced Strategies for Value Investors

- Special Situations Investing – Seeking opportunities in mergers, spin-offs, or restructuring events.

- International Value Hunting – Many undervalued companies are outside the U.S.

- Deep Value – Investing in severely undervalued, turnaround companies (higher risk, higher reward).

- Dividend Growth Value Investing – Combining undervaluation with a rising dividend track record.

Final Thoughts

Value investing in 2025 is not about ignoring chang it’s about applying timeless principles with modern tools and global opportunities. While the landscape has evolved, the core philosophy remains the same: buy great companies at fair or discounted prices, hold them patiently, and let time and fundamentals do the heavy lifting.

Investors who can combine data-driven analysis, emotional discipline, and long-term vision are well-positioned to succeed, regardless of how technology transforms the market.