Investors often debate whether long-term or short-term strategies are more effective. Each has its own benefits and risks, and the best choice depends on your financial goals, risk tolerance, and time horizon.

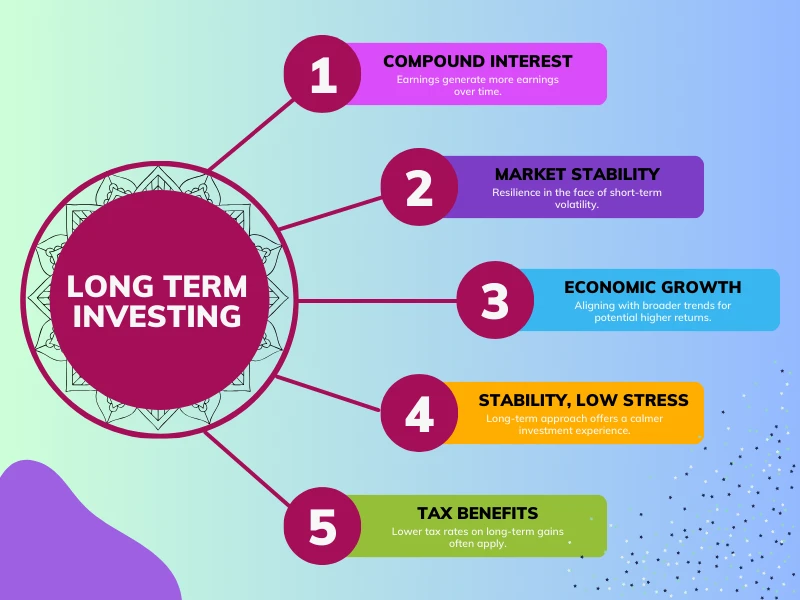

Long-term investing involves holding assets for years or even decades. This approach benefits from compound growth and is less affected by short-term market fluctuations. It’s ideal for retirement savings or building wealth over time. Long-term investors typically focus on stable companies, mutual funds, or index funds.

Short-term investing, on the other hand, involves buying and selling assets over days, weeks, or months. It aims to capitalize on market volatility and quick price movements. Traders may use technical analysis, news events, or economic indicators to time their trades. While short-term strategies can produce fast gains, they also carry higher risk and require constant monitoring.

A key advantage of long-term investing is lower transaction costs and potential tax benefits. It also reduces emotional decision-making since investors aren’t reacting to daily market news. Short-term investing can be rewarding for experienced traders who have time and discipline.

Choosing the right strategy depends on your personality and financial situation. Many investors use a combination of both, maintaining a core long-term portfolio while allocating a portion for short-term opportunities.

Additionally, long-term investing promotes a habit of regular saving and allows for a more passive investment style. It supports building a stable financial future with less day-to-day stress. Short-term investing, while potentially profitable, demands advanced knowledge, strict risk management, and emotional resilience. Some investors adopt swing trading or day trading methods, which require detailed analysis and time commitment. In the end, balancing both strategies with a clear financial plan can offer flexibility, growth, and security.

Long-Term vs. Short-Term Investing: Finding the Right Balance for Your Goals

The debate between long-term and short-term investing has been around for decades. Supporters of each approach can point to success stories the patient investor who held a stock for 30 years and retired wealthy, and the skilled trader who doubled their account in a few months. The truth is, both strategies can work but they serve different purposes and require very different mindsets.

What Is Long-Term Investing?

Long-term investing means holding assets for years or even decades, with the expectation that they will grow in value over time.

This approach is often compared to planting a tree: you put in the work at the start, and with patience and care, it grows steadily, producing shade or fruit year after year.

Typical long-term investments include:

- Index funds and ETFs tracking broad markets like the S&P 500.

- Blue-chip stocks from companies with strong balance sheets and proven track records.

- Bonds and fixed-income instruments for steady returns.

- Real estate properties generating rental income.

- Retirement accounts (401(k), IRA) that benefit from decades of compounding.

Why it works:

The power of compound growth where your investment earns returns, and those returns themselves start earning more is exponential over long periods. Even modest annual returns can snowball into substantial wealth if given enough time.

What Is Short-Term Investing?

Short-term investing (or trading) involves buying and selling assets within days, weeks, or months. The focus is on capitalizing on market volatility the daily and weekly price swings that create opportunities for quick profits.

Common short-term methods include:

- Day trading – Buying and selling in the same day.

- Swing trading – Holding for several days or weeks to capture medium-term price moves.

- Event-driven trading – Reacting to earnings reports, product launches, or economic data releases.

- Options trading – Leveraging contracts for higher potential gains (and higher risk).

Why it appeals:

The possibility of fast returns is attractive. A single well-timed trade can generate profits equivalent to months of steady long-term growth. But the risks are much higher losses can also come quickly.

The Advantages of Long-Term Investing

- Lower Transaction Costs

Fewer trades mean fewer fees and commissions eating into your profits. - Tax Efficiency

In many countries, holding assets for over a year qualifies for lower capital gains tax rates. - Reduced Emotional Stress

You’re not glued to a screen reacting to every price fluctuation. - Passive Growth

It allows you to focus on other areas of life or business while your portfolio works in the background. - Benefit from Market Resilience

Historically, markets recover from downturns and trend upward over decades.

Example:

If you had invested $10,000 in an S&P 500 index fund in 1993 and left it untouched until 2023, it would have grown to well over $100,000 (even after accounting for multiple recessions).

The Advantages of Short-Term Investing

- Quick Capital Turnover

Gains can be realized and reinvested multiple times in a year. - Opportunity in All Market Conditions

Traders can profit from both rising and falling markets using tools like short selling or options. - Flexibility

Positions can be adjusted rapidly based on market changes. - Leverage Potential

Some short-term strategies use borrowed capital to magnify gains (though this also magnifies losses).

Example:

A swing trader spots a breakout in a tech stock and earns 15% in three weeks far exceeding average annual market returns.

Risks to Consider

Long-Term:

- Requires patience large gains may take years to materialize.

- Can underperform if you buy at market peaks without averaging down.

- Inflation can erode purchasing power if returns are too low.

Short-Term:

- High emotional pressure fear and greed can lead to poor decisions.

- Higher transaction costs from frequent trading.

- Significant risk of large, rapid losses.

- Requires deep market knowledge and constant attention.

Which Strategy Fits You?

Choosing depends on:

- Your goals — Are you building retirement savings or seeking income right now?

- Time availability — Can you monitor trades daily, or do you prefer a hands-off approach?

- Risk tolerance — Are you comfortable with volatility and possible losses?

- Experience — Do you understand technical analysis, market cycles, and risk management?

Combining Both Approaches

Many experienced investors find value in blending the two:

- Core portfolio (long-term): 70–90% in diversified, stable investments for consistent growth.

- Satellite portfolio (short-term): 10–30% for trading opportunities or high-conviction plays.

Example:

Jane invests $80,000 in index funds and blue-chip stocks for the long haul, and uses $20,000 to actively trade growth stocks or ETFs based on market trends.

Advanced Tips for Each Strategy

For Long-Term Investors:

- Automate contributions to retirement or brokerage accounts.

- Reinvest dividends to maximize compounding.

- Periodically rebalance your portfolio to maintain target allocations.

- Ignore day-to-day noise and focus on fundamentals.

For Short-Term Traders:

- Set strict stop-loss orders to limit downside.

- Keep a trading journal to track wins and mistakes.

- Manage position sizes to avoid catastrophic losses.

- Stay informed with economic calendars and earnings schedules.

Psychology Plays a Role

- Long-term investing thrives on patience and a “big picture” mindset. You accept that there will be downturns but trust in the market’s long-term upward trend.

- Short-term investing demands quick thinking, decisiveness, and the ability to detach emotionally from each trade.

Bottom Line

Long-term investing is a proven path to building wealth with less day-to-day stress, while short-term investing offers potential for faster gains but comes with greater demands and risks. The best approach might not be an either/or decision combining both can give you stability, flexibility, and the ability to seize opportunities.

If you choose to blend them, make sure you:

- Have a clear plan for each portion of your portfolio.

- Keep your long-term investments protected from the temptation of short-term trading.

- Review your performance regularly and adjust based on results.

Historical Lessons From Each Approach

Looking back at market history offers valuable perspective:

Long-Term Example:

If an investor had bought shares of Johnson & Johnson in 1980 and held them until today, they would have benefited from decades of consistent dividend payments and price appreciation. Even through recessions, product recalls, and market crashes, the stock has multiplied in value many times over, turning a relatively modest investment into a significant nest egg.

The lesson? Long-term investing rewards consistency, short-term trading rewards skill and timing but mistiming short-term trades can lead to losses just as quickly as gains.

How Time Horizon Shapes Risk

The biggest difference between the two strategies is how time changes the nature of risk.

In the short term, stock prices are heavily influenced by news cycles, earnings reports, and investor sentiment all of which can cause sharp moves that have little to do with a company’s true long-term value.

In the long term, fundamentals matter more than headlines. A company with steady earnings growth, good management, and a strong competitive position will usually see its stock price trend upward over the years, regardless of temporary setbacks.

This is why short-term investing is closer to speculation, while long-term investing is closer to wealth-building.

Common Mistakes to Avoid

Long-Term Investors Often Fail By:

- Checking portfolios too frequently and panicking during downturns.

- Not rebalancing when one asset class grows too large, increasing risk unintentionally.

- Neglecting diversification, which leaves them vulnerable if their chosen assets underperform.

- Forgetting inflation — keeping too much in low-yield investments can erode purchasing power.

Short-Term Traders Often Fail By:

- Overtrading — excessive buying and selling leads to high fees and tax bills.

- Ignoring risk management — risking too much capital on a single trade can wipe out months of gains.

- Letting emotions drive decisions — fear of missing out (FOMO) or panic-selling after a loss.

- Failing to adapt — market conditions change, and strategies that worked last year may fail this year.

Blended Strategy in Action

Some of the most successful investors use a hybrid approach.

For example:

- Core holdings in long-term investments like index funds, dividend stocks, or real estate.

- Tactical trades to take advantage of short-term opportunities in specific sectors or events.

This balance allows them to enjoy the security and compounding of long-term assets while also adding a layer of potential extra returns from short-term plays.

Practical Allocation Models

Here are a few sample allocation splits depending on personality and goals:

- Conservative Long-Term Focus:

- 90% long-term holdings (broad market ETFs, bonds, blue-chip stocks)

- 10% short-term trading capital

- Balanced Growth:

- 70% long-term investments

- 30% active short-term positions

- Aggressive Trader:

- 50% long-term

- 50% short-term, with strict risk controls

These are not one-size-fits-all they’re starting points. Your ideal ratio should reflect your comfort with volatility, your experience level, and your time availability.

Final Takeaway on Choosing Your Approach

Ultimately, the decision isn’t about proving which method is “better.” It’s about understanding that:

- Long-term investing thrives on patience, discipline, and the ability to ride out downturns without panic.

- Short-term investing rewards skill, adaptability, and strict control over emotions and risk.

If you can combine the stability of the long-term approach with the flexibility of selective short-term moves and you stick to a clear plan you can create a portfolio that is both resilient and opportunistic.